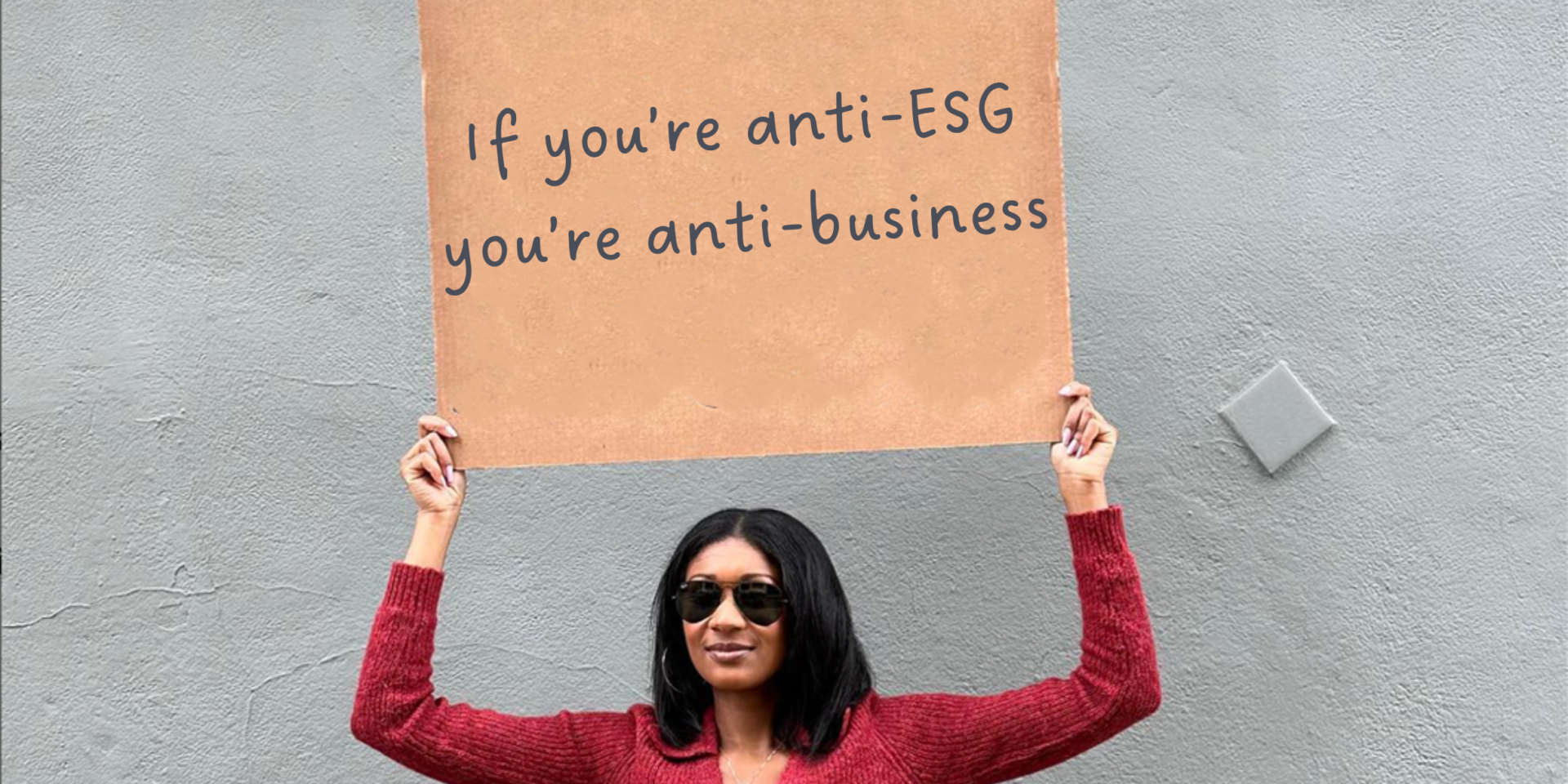

Is Anti-ESG Really Another Way to Say Anti-Business?

The discussion surrounding Environmental, Social, and Governance (ESG) issues has become a hot topic in the investment world in recent years. Now, that discussion about these three key factors organizations use to evaluate and report their performance in sustainability, social responsibility, and corporate governance has now morphed into a politically charged, controversial debate.

On one side of the debate, ESG proponents argue that incorporating ESG into investment decisions will lead to long-term sustainable growth and positive societal impact. As such, they vigorously argue that these factors are crucial to the long-term success of organizations. On the other hand, critics (also known as anti-ESG) argue that ESG concerns detract from the bottom line and that metrics can be vague and difficult to measure, leading to an increased focus on non-financial factors at the expense of shareholder value.

But what does this really all mean for business?

The Anti-ESG Movement

The anti-ESG movement is a term used to describe a group of investors, business executives, and politicians who are skeptical or critical of the concept of ESG investing. Somehow, the idea has surfaced and now percolated that this style of investment, which takes into account a company’s performance in environmental, social, and governance areas alongside, not in lieu of, traditional financial metrics is bad for business.

Those in this movement argue that ESG investing can limit investment opportunities and returns, as it may exclude certain industries or organizations that do not meet certain criteria. With skepticism that ESG factors can be measured or always align with shareholder value, they argue that organizations should focus primarily on maximizing profits and generating returns for investors, rather than worrying about social and environmental issues. Further, they contend that ESG metrics are subjective, making it difficult to compare organizations across different industries and geographies and that ESG investing can be used as a tool for political or social activism, rather than purely financial decision-making. And they are all getting louder.

ESG’s Positive Impact on Business

Critics of the anti-ESG movement are rising to the challenge—getting louder with their own arguments and rebuttals. They argue that regardless of the reason someone is anti-ESG, the negative impacts on business are ultimately the same. In contrast to the arguments purported, they point to the fact that ESG factors are increasingly important to investors, as they can have a significant impact on an organization’s long-term performance and sustainability. They also argue that ESG metrics are becoming more standardized and objective, making it easier to compare organizations across different sectors and geographies.

Further, critics of anti-ESG argue that organizations that prioritize these factors are more likely to attract socially and environmentally conscious consumers and investors. In today’s society, many consumers are looking for products and services that align with their values, and they are willing to pay a premium for organizations that demonstrate a commitment to sustainability and social responsibility. By ignoring ESG concerns, organizations may be missing out on a significant segment of the market and potentially losing revenue.

Finally, they focus on the fact that organizations that prioritize these factors may be better positioned to mitigate risks and manage crises. For example, organizations that have strong governance practices may be less likely to face legal and regulatory penalties, and those that are environmentally responsible may be less vulnerable to climate-related risks. As such, they decrease their likelihood of reputational damage and financial losses.

Essentially, anti-ESG means that leaders are not prioritizing or valuing the importance of sustainable business practices, social responsibility, or strong corporate governance. By disregarding ESG considerations, they are neglecting a set of principles that are essential to building a successful and sustainable business. Not only is the potential long-term success and growth of the organization undermined, but in some cases, it is even put at risk.

It’s Time for Action … and Transparency

While those on each side of the debate are getting louder by the day, some leaders are attempting to remain neutral. However, leaders cannot avoid this or any controversial topic. To the contrary, they have a business and moral obligation not to stay quiet but to address these issues head-on with courage. According to an article in Harvard Business Review, “Organizations can’t sit on the sidelines anymore because, well, there are no sidelines. In a transparent world, your silence will speak volumes. Roughly 70 to 90% of respondents in the 2023 Edelman Trust Barometer said they ‘expect CEOs to take a public stand on issues’ such as climate change, discrimination, and the wealth gap.”

As the debate between the pro- and anti-ESG camps rages on, the trend toward greater transparency and accountability in corporate behavior is undeniable. Regardless of which side of the debate leaders fall on, it is clear that the demand for more transparent and accountable corporate behavior is only going to increase in the coming years. Consumers and investors alike are becoming more socially and environmentally conscious, and they are demanding that organizations align with their values. As a result, organizations that fail to address ESG concerns may face reputational damage and potential financial losses.

Furthermore, the regulatory landscape is also shifting toward more ESG-focused policies. Governments around the world are implementing regulations that require organizations to disclose their ESG performance and risks. In fact, some are even implementing mandatory ESG reporting standards. This means that organizations that do not prioritize ESG factors may find it increasingly difficult to access capital and meet regulatory requirements.

The relationship between ESG and business interests is complex and multifaceted. While some may view ESG concerns as detracting from the bottom line, others argue that these factors are crucial to the long-term success of organizations. Ultimately, the decision to prioritize ESG concerns will depend on an organization’s specific circumstances and goals, as well as the values of its stakeholders.

We’re not claiming any of this is necessarily easy. But part of being a leader is having courage … to do the right thing, to defend your team, and to forge a path into the unknown often with only a vision and determination. These all take courage, and so does proudly standing up to say what you believe in and what your organization stands for as it relates to ESG (or to anything else). Staying silent in the face of adversity isn’t courageous leadership. And the time for silence regarding ESG is long gone. Rather, if we truly value the longevity and success of our organizations, when the ESG critics get loud, we must continue to get even louder.

At The Win Woman, we focus on Environmental, Social, and Governance strategic development and policies for organizations of all sizes and funding opportunities for nonprofits. We work with boards and C-Suite executives to help develop the right solutions for their specific situation in their specific industry. For more information, please contact us.

Until next time, keep Building Your BADASSERY!